Stepper motors are electromagnetic devices that realize electrical energy conversion or transmission based on the law of electromagnetic induction. Their principles, structures, performances, functions, and operating conditions are adapted to the requirements of special machinery. Commonly used in control systems, they fulfill functions such as detection, calculation, amplification, execution, or conversion of electromechanical signals or energy; they can also be used to drive mechanical loads or serve as AC/DC power generators for equipment. Stepper motors have a wide range of downstream applications—they can be found in almost all occasions requiring electric drive. Globally, they are mainly used in household appliances, automotive component equipment, medical devices, electronic information, robots, aerospace, industrial machinery, military, and other fields.

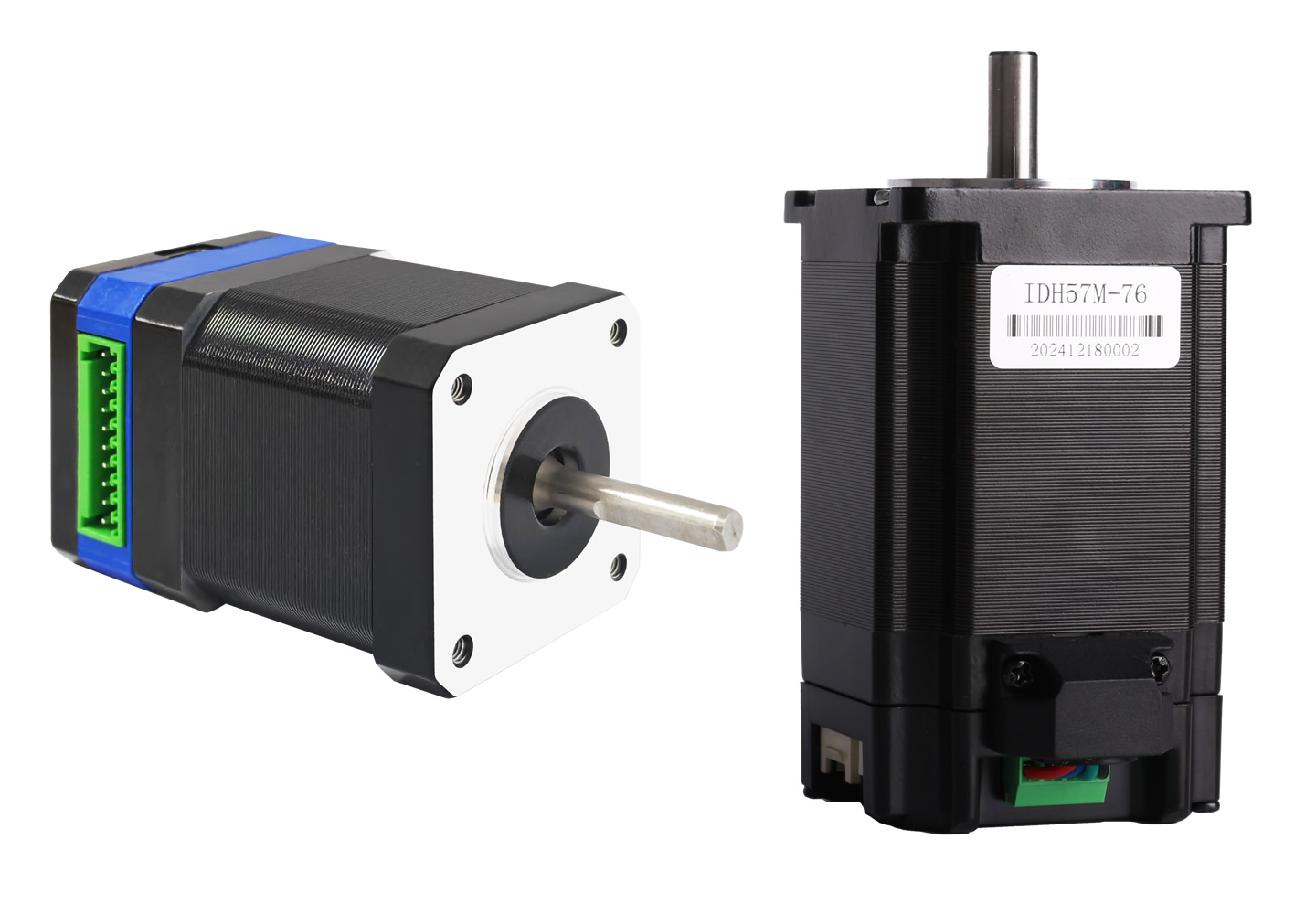

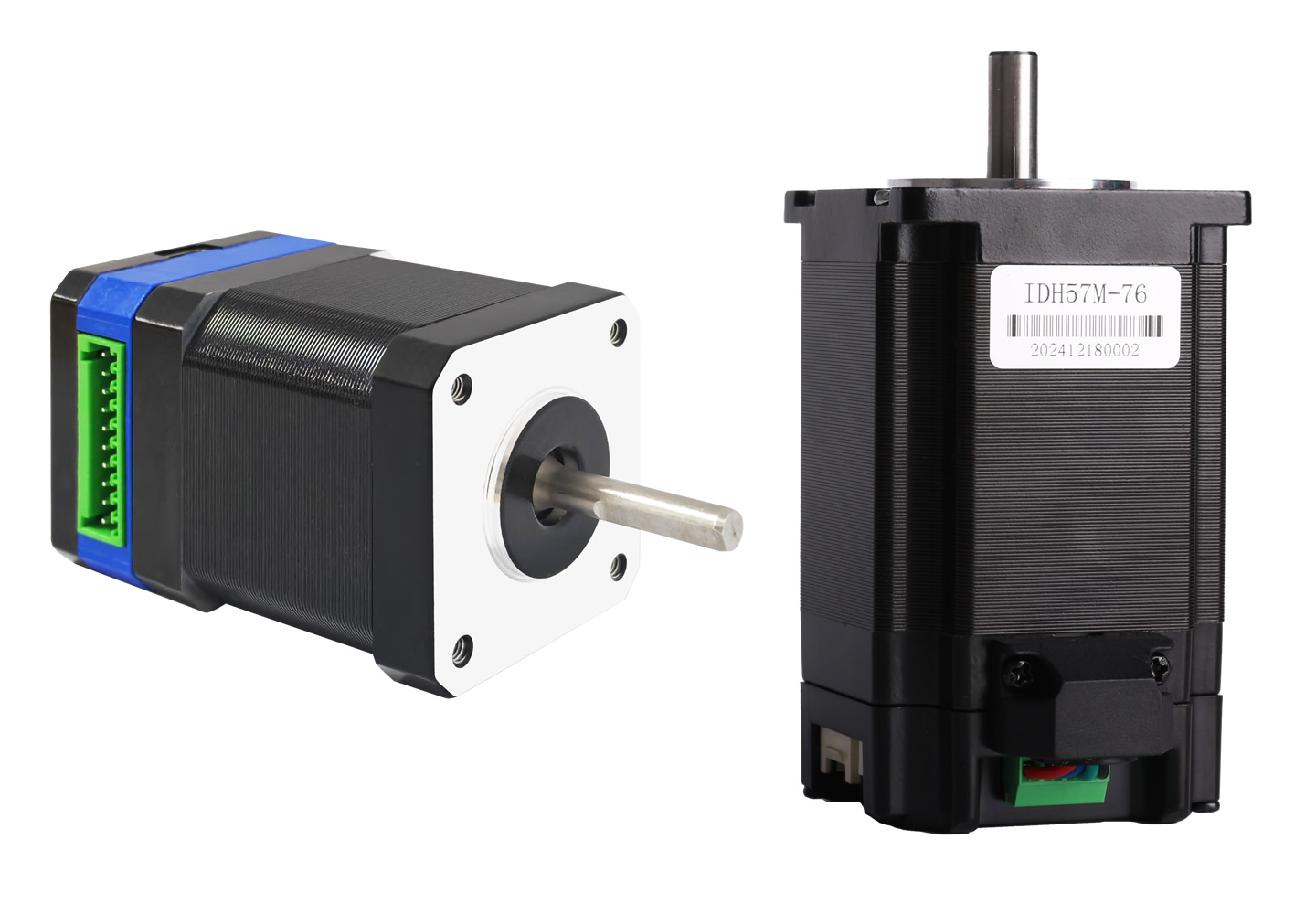

Motors can be divided into drive motors and control motors by application. Control motors can be further classified into stepper motors and servo motors (including brushless motors), etc. A stepper motor is a type of motor that converts electrical pulse signals into corresponding angular or linear displacement. For each input pulse signal, the rotor rotates by an angle or moves one step forward. Its output angular or linear displacement is proportional to the number of input pulses, and the rotational speed is proportional to the pulse frequency. Therefore, stepper motors are also known as pulse motors.

The biggest difference between stepper motors and other control-purpose motors is that they receive digital control signals (electrical pulse signals) and convert them into corresponding angular or linear displacement—they are themselves executive components that complete digital mode conversion. Moreover, they support open-loop position control: inputting one pulse signal achieves a specified position increment. Compared with traditional DC control systems, such incremental position control systems have significantly lower costs and require almost no system adjustment. The angular displacement of a stepper motor is strictly proportional to the number of input pulses and synchronized with the pulses in time. Thus, the required rotation angle, speed, and direction can be obtained by controlling the number of pulses, frequency, and phase sequence of the motor windings.

There are three types of stepper motors: Permanent Magnet (PM), Variable Reluctance (VR), and Hybrid Stepper Motors. PM stepper motors can achieve high torque output with a typical step angle of 1.5 degrees, but they produce significant noise and vibration and were phased out in developed countries such as Europe and the United States in the 1980s. VR stepper motors have smaller torque and volume, with step angles of generally 7.5 degrees or 1.5 degrees. Hybrid stepper motors combine the advantages of PM and VR types. They are further divided into two-phase, three-phase, and five-phase: two-phase stepper motors typically have a step angle of 1.8 degrees, while five-phase ones have a step angle of 0.72 degrees. As the number of phases (energized windings) increases, the step angle of hybrid stepper motors decreases and precision improves, making them the most widely used type. The rotor of a hybrid stepper motor is inherently magnetic, so it generates greater torque than a VR stepper motor under the same stator current and usually has a smaller step angle. Therefore, economical CNC machine tools generally use hybrid stepper motors for drive.

Stepper motors rotate through the interaction between a magnetic rotor core and a pulsed electromagnetic field generated by the stator. Linear actuators (lead screw stepper motors) convert rotational motion into linear motion inside the motor. The basic principle of a linear actuator is to use a lead screw meshed with a nut, and prevent relative rotation between the lead screw and the nut through a certain method to achieve axial movement of the lead screw. Generally, there are two ways to achieve this conversion currently: the first is to incorporate a rotor with internal threads inside the motor, which meshes with the lead screw to realize linear motion—known as a through-type linear actuator. The second is to use the lead screw as the motor's main shaft and mesh it with an external drive nut outside the motor to achieve linear motion—known as an externally driven linear actuator. In applications where mechanical devices cannot provide nut or lead screw anti-rotation, models based on the first two types can be selected. Through built-in splines or slide rails (the spline cooperates with the spline sleeve at the front of the motor to prevent rotation, or the nut cooperates with the slide rail sleeve to push the sliding shaft), linear motion of the motor is achieved. This type of motor is called a fixed-shaft linear actuator. Completing the conversion from rotation to linear motion directly inside the motor is highly significant: it simplifies the design of rotation-to-linear transmission, replaces traditional gear-rack transmission, belt transmission, and coupling methods, and is more suitable for occasions requiring precise motion.

Servo refers to a control system that takes physical quantities such as position, orientation, and posture of an object as controlled variables and can track arbitrary changes of the target. A servo motor is an engine that controls the operation of mechanical components in a servo system, acting as an auxiliary motor indirect speed change device. Due to its rotor speed being controlled by input signals and its rapid response, servo motors are used as executive components in automatic control systems. Servo motors are divided into DC and AC servo motors. Most servo systems adopt permanent magnet synchronous AC servo motors, and control drives mostly use full-digital position servo systems for fast and accurate positioning. Currently, stepper motors are widely used in digital control systems, but with the emergence of full-digital AC servo systems, AC servo motors are increasingly applied in digital control systems.

A reducer is an independent component composed of gear transmission, worm transmission, or gear-worm transmission enclosed in a rigid housing. It is commonly used as a speed reduction transmission device between a prime mover and a working machine or executive mechanism, playing the role of matching rotational speed and transmitting torque. It is widely used in modern machinery. Reducer products are mainly small and micro planetary reducers, whose main function is to cooperate with motors to transmit greater output torque and ensure precision requirements. They are widely used in cleaning robots, AGV warehouse carts, medical devices, intelligent tracking, speed gates, pan-tilt heads, stage lighting, and other fields.

With the continuous development of the motor industry, the extension and connotation of motor products have been expanding. Motor products are widely used in metallurgy, building materials, papermaking, municipal engineering, water conservancy, shipbuilding, and other fields. The versatility of motors is gradually shifting towards specialization, breaking the past pattern where the same motor was used for different load types and application scenarios. Motors are developing in the direction of specialization, specialization, and personalization.

Many domestic enterprises are also transforming into professional enterprises, and a company's ability to adapt to non-standard customization is an important measure of its future development potential. Before the 1980s, a few enterprises or military-industrial enterprises in the United States, Britain, France, the Soviet Union, and other countries monopolized the global precision micro-motor market. Later, Japan, Germany, Italy, and other countries developed rapidly, with product levels among the world's advanced. With the development of economic globalization and global industrial transfer, the micro-motor industry began to shift to developing countries. As a representative of developing countries, China undertook the transfer of micro-motors from developed countries such as Japan and South Korea. China's micro-motor industry has gone through stages of imitation, independent design, and R&D, and has now formed a complete industrial system covering product development, large-scale production, and supporting of key components, key materials, special manufacturing equipment, and testing instruments. In the early 1960s, many enterprises and research institutes specializing in the production of micro-motors were established in China, independently designing various micro-motor products such as contact synchros, AC and DC servo motors. In the 1980s, to meet the demand of the household appliance market and the wide application and popularization of microcomputers, stepper motor production lines were introduced, and wide-speed-regulating DC servo motors and military micro-motors were developed. After the 1990s, due to the transfer of foreign home appliance production capacity to China and the rapid development of the domestic home appliance market, the micro-motor industry accelerated its development, launching new products such as permanent magnet AC servo motors and brushless DC motors. Meanwhile, with the further improvement of control theory and the wide application of integrated circuits, motor control technology has developed rapidly.

China has become the world's largest producer of micro-motors. In 2023, the production and sales volume of micro-motors in China reached approximately 15.1 billion units. Statistical data shows that the global micro-motor market size was USD 46.74 billion in 2024 and is expected to reach USD 76.99 billion by 2032. With the deepening of industrial automation in global manufacturing and the continuous development of the medical device industry, the global micro-motor industry will continue to show a steady development trend.

The global stepper motor market size reached USD 2.079 billion in 2022, of which the Chinese market accounted for the largest share at approximately 63%, and the US market accounted for about 11%. By 2023, the market size reached RMB 3.66 billion. To support the development of the stepper motor industry, the Chinese government has introduced a series of policies, including technological innovation plans and technical standardization regulations, to promote technological progress and industrial development. The stepper motor market has broad space, and the market size is expected to continue expanding in the future. According to data from CICC Enterprise Credit Research, it is expected to reach USD 2.411 billion by 2029, with a CAGR of 1.7% from 2022 to 2029.

The global brushless DC motor industry has a relatively fragmented competitive landscape, with no absolute monopoly or oligopoly formed. Significant progress has been made in brushless DC motors in terms of control algorithms, material science, and production processes. These technological innovations have improved the efficiency, power density, and reliability of motors, making brushless DC motors more superior in performance and thus meeting the needs of more application scenarios. Compared with traditional motors, brushless DC motors have higher energy efficiency ratios, which can significantly reduce energy consumption and carbon emissions. With the global emphasis on energy conservation, emission reduction, and sustainable development, brushless DC motors are being increasingly widely used, becoming an important factor driving market growth.

Governments around the world have introduced policies to support the development of new energy industries, intelligent manufacturing, and other fields, providing broad development space for the brushless DC motor industry. For example, the Chinese government has continuously increased support for new energy vehicles, intelligent manufacturing, and other fields, driving the rapid growth of the brushless DC motor market. The increasingly strict environmental regulations have put forward higher requirements for motor production and application. As a representative energy-saving and environmentally friendly product, brushless DC motors meet the requirements of environmental regulations and thus have received more and more attention and adoption in the market. According to the analysis of the development status of the brushless DC motor market, with the continuous development of the global economy and the improvement of people's living standards, the demand for efficient, energy-saving, and environmentally friendly motor products is increasing. Brushless DC motors have met market demand with their excellent performance and wide application fields, promoting the continuous growth of the market. Modern consumers have higher requirements for product performance, quality, and intelligence. Brushless DC motors have won consumers' favor with their high efficiency, energy saving, low noise, intelligence, and other characteristics, driving the rapid development of the market.

Statistical data shows that the global brushless DC motor market size reached USD 20 billion in 2023. As the world's largest producer and consumer of motors, China also occupies an important position in the brushless DC motor market. The size of China's brushless DC motor market has exceeded RMB 1.5 trillion, and by the end of 2023, it reached RMB 50 billion.

In recent years, with the continuous improvement of manufacturing automation and the rapid development of emerging industries, the global servo motor market size has been expanding. According to data from CICC Enterprise Credit Research, the global servo motor market has maintained a stable growth trend in the past few years. In 2023, the size of China's servo motor market was approximately RMB 19.5 billion, a year-on-year increase of 7.73%. In 2024, the size of China's servo motor market is expected to exceed RMB 20 billion. It can be seen that the size of China's servo motor market is increasing year by year, reflecting a sound development trend of the industry in China. According to statistical data, the size of China's servo system market is expected to reach approximately RMB 65 billion by 2027, with a compound annual growth rate of about 7.2%. In addition, by 2029, the size of China's servo system market will exceed RMB 50 billion, with a compound annual growth rate of about 11.1%.

Micro-motors have a wide range of downstream applications, including household appliances, medical devices, electronic information, aerospace, industrial machinery, and many other fields. China's micro-motor manufacturing industry has made considerable progress, especially in the Yangtze River Delta, Pearl River Delta, and Bohai Bay Rim regions, which have formed important production and export bases for China's micro-motors.

China is the world's largest producer of micro-motors. Currently, China's micro-motor industry has formed a basically complete micro-motor industrial system covering product development, production, and supporting of key components, key materials, special manufacturing equipment, and special testing instruments. China's micro-motor industry is in a stage of rapid development. China is vigorously promoting industrial upgrading and economic restructuring, driving the accelerated development of industrial intelligence and automation, which has put forward higher requirements for production technology and equipment in various industries, thus bringing more challenges and opportunities for the development of the micro-motor industry. However, the development of high-end motors in China lags behind, with low production technology and low market share of leading enterprises. High-end micro-motors have high barriers, and domestic enterprises still have a gap compared with the international advanced production technology level. In the future, they are expected to gradually promote domestic substitution by relying on cost-effectiveness and localized service advantages. The future technical development trends of the motor industry are as follows:

Energy Conservation and High Efficiency: Under the framework of energy conservation and emission reduction, developing high-efficiency and energy-saving motors has become an industry consensus, and such motors will drive the rapid development of the industrial chain. Policies such as the "Motor Energy Efficiency Improvement Plan" and the "Industrial Energy Efficiency Improvement Action Plan" have also clearly proposed to vigorously develop high-efficiency and energy-saving motors. Driven by policies and other factors, the penetration rate of high-efficiency and energy-saving motors is expected to accelerate in the future.

More Compact and Refined Motor Structure: The future development of smart cities and industrial automation will significantly increase the demand for intelligent robots and automated equipment, and it is expected that intelligent robots and automated equipment will achieve large-scale development. Their operation will inevitably require motor drive, and these precise operations will also require motors to be more compact and refined.

Specialization, Specialization, and Personalization: With the continuous development of the motor industry, the extension and connotation of motor products have been expanding. Motor products are widely used in metallurgy, building materials, papermaking, municipal engineering, water conservancy, shipbuilding, and other fields. The versatility of motors is gradually shifting towards specialization, breaking the past pattern where the same motor was used for different load types and application scenarios. Motors are developing in the direction of specialization, specialization, and personalization. Many domestic enterprises are also transforming into professional enterprises, and a company's ability to adapt to non-standard customization is an important measure of its future development potential.